Article Contents

Introduction

There’s a lot to think about for yourself and your family as you prepare to leave the army. One of the most important topics of discussion is Healthcare Coverage Options for Veterans.

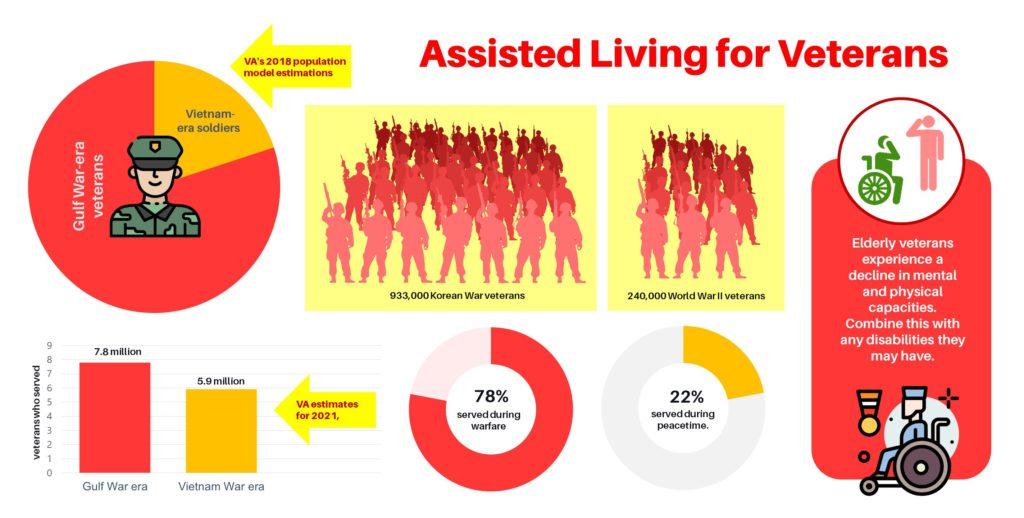

According to the recent 2020 US Census, about 17.4 million military personnel are retired and live as proud veterans of the country as of today. Among them, more than 25% veterans rely on Veteran Affairs (VA) for healthcare insurance coverage. Additionally, more than 75% of US veterans have multiple medical insurance coverages to access healthcare services opportunities after retirement. (Source: US Census report)

The US government tremendously values military veterans and their dependents through different healthcare plans and insurance programs. Yet, many veterans know little about the benefits they can avail for lack of information and resources. So, it’s crucial to start planning now before you retire and everything becomes a stress in your life.

Medical Care Benefits for Military Veterans and Their Families

Military Veterans and Their Families Have Access to Different Medical Care Benefits. Here are some of the options:

1. VA Health Care

The department of Veteran Affairs (VA) provides medical care benefits to military veterans and their families. The medical benefits available for retired veterans comprehensively cover primary care, special practitioners, diagnostics, and inpatient and outpatient care services. An enrolled military veteran might also be eligible for dental care facilities in certain cases. VA will generally cover those services if veterans receive them at a VA facility.

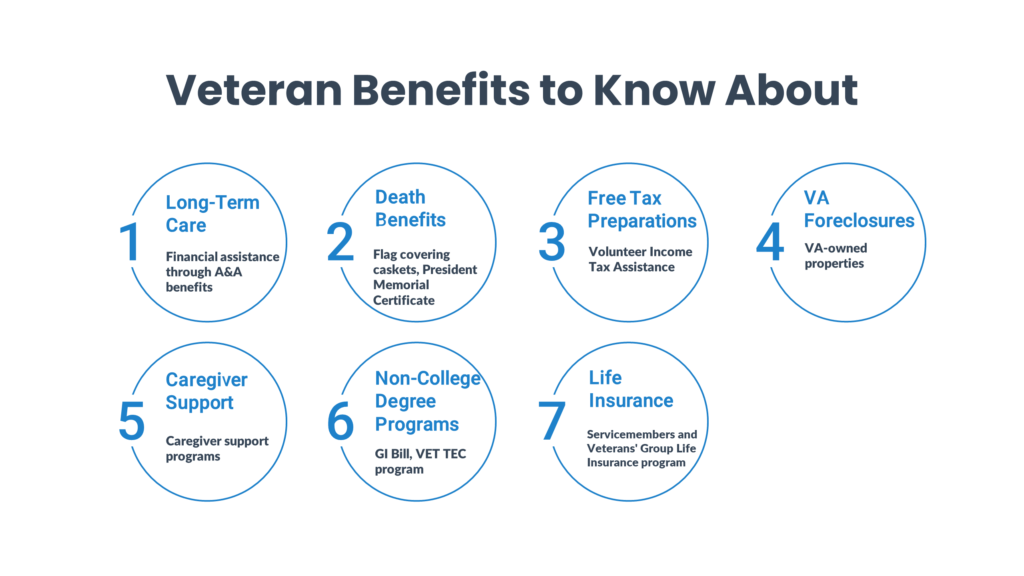

As an eligible military veteran for medical benefits, you will get access to other services too. These VA benefits include dental care, mental health care services, assisted living and home health care; prescription drugs approved by a VA doctor; ancillary services like therapy and rehabilitation services, audiology, and radiation oncology.

Under the mental healthcare program, you can get services for any general mental health problems as well as unique issues to your case. For instance, you can get treatment for substance abuse, post-retirement stress disorder, military sexual harassment and abuse, and any other severe mental illness.

The long-term care services VA provides to the sick and disabled veterans include: round-the-clock medical care, assistance with daily activities, physical therapy, comfort care, and caregiver assistance. These services are provided in various settings, such as assisted living, nursing homes, adult day health centers, etc.

2. The TRICARE Program

Many military veterans and their families are covered via TRICARE, an extensive military health care program. Under TRICARE, there are different coverage options and insurance plans to choose from. Beneficiaries receive services at military hospitals, clinics, and some selected civilian hospitals and providers’ offices. Veterans can also enjoy VA health care benefits even if they are enrolled in TRICARE. In that case, VA pays first for its covered services. But for non-covered care needs, TRICARE pays. TRICARE also includes dental and vision benefits, cancer treatment, and hospice care.

3. Medicare

Medicare, a federal health insurance program, is available for veterans aged 65 or older. Even younger veterans with disabilities can seek Medicare support. Veterans can have both Medicare and VA healthcare. But Medicare does not cover the care provided at a VA facility. It only pays for services veterans receive at Medicare-certified facilities. Check out our Medicare benefits guide to find out more about this beneficial program.

CHAMPVA: The Civilian Health and Medical Program of the Department of Veteran Affairs

VA also provides health care benefits for dependents of veterans under the CHAMPVA program. It shares the costs of approved medical services with eligible beneficiaries. CHAMPVA is similar to TRICARE but offered by the VA.

Dependents of veterans like their spouses and children are only eligible for CHAMPVA if they are not eligible for TRICARE. There are other eligibility criteria as well, and dependents must be included in any of these categories:

- Spouse or child of a service-related disabled veteran

- Surviving spouse or child of a deceased veteran

- Surviving spouse or child of a veteran who died during service

Choosing the Post-Military Healthcare Coverage for Veterans

As you have seen by now, there are several healthcare insurance options available for military veterans, their families, and dependents. However, you will need to be aware of the costs before enrolling for any of the benefit programs. The Federal Reserve survey has shown us that around 40% Americans end up incurring a debt when covering a $400 insurance bill. Thus, ask the following 4 questions before you select a veterans healthcare program.

1. What are the health care needs you have?

A single veteran has different needs than a married veteran with children. Children require more extensive medical attention, although young adults may need less. Consider whether you have any pre-existing medical conditions that veteran healthcare benefits could cover.

2. Which healthcare plan do you qualify for?

Each healthcare coverage option will provide different benefits to you. As a result, they also have their own rules and standards. Do you qualify perfectly for any of the benefits? Evaluate your eligibility first before diving into any of the vets’ options.

3. Which healthcare plan makes the most financial sense?

Finally, don’t forget to test and compare various plans’ upfront prices and deductibles. Make sure that you don’t make a decision based purely on cost. Instead, assess your needs and make sure the plan you choose provides enough coverage.

4. How does Veterans Health Administration differ from VA benefits?

So, you have 2 central option in your hand. One is the Veteran Health Administration (VHA) and the other one is the VA benefits. Firstly, the VHA provides healthcare support for retired military personnel. On the other hand, VA benefits are insurance programs to cover healthcare expenses.

Medical care is the main priority of the VA. But this depends on several factors, including your income, service in the military, and disability status. The VA would be able to help you if you have a service-related disability that requires ongoing care.

Terms for Post-Military Health Insurance Costs

Get to know the terms below as you learn new health insurance lingo for senior veterans. They all refer to charges that you will be accountable for.

- Premiums

This is the monthly premium you’ll pay for your insurance.

- Deductibles

A deductible is a fee you must pay out of pocket before your insurance coverage comes in. Your insurance takes over once you’ve paid your deductible. Consider the following scenario: you have a $2,000 deductible and a $10,000 operation. You’d be responsible for $2,000, while insurance would cover the rest. You usually only have to pay for co-insurance or co-pays after you’ve met your deductible.

- Co-Pays and Co-Insurance

These fees are paid at the time of service, such as a $20 co-pay for a doctor’s appointment.

- Out-Of-Pocket Maximum

Aside from your premiums and any undisclosed charges, this is the most you’ll pay in a single insurance year.

Retiring vs. Resigning: Why It Matters

You won’t be eligible for TRICARE if you’re leaving the military. However, as a civilian, you’ll be able to buy health insurance.

TRICARE is only available to retirees. Sean Scaturro, the USAA Advice Director, suggests that enrolling in TRICARE is only recommended if you have access to physicians who accept it the low costs – premiums, deductibles, etc.

Any provider who accepts Medicare should also accept TRICARE. If you are unsure if a doctor or other health care provider accepts TRICARE, contact them beforehand to check. Rural places may have fewer doctors who accept TRICARE, and might require you to travel a long distance.

You can get health insurance through your workplace, the federal healthcare marketplace or a commercial insurer like USAA, if you don’t want to travel and don’t have TRICARE providers in your region.

TRICARE offers several temporary health insurance options for you and your family that can be useful when you leave the military. That includes:

The CHCBP is a great premium-based plan if you want to be covered for 18-36 months once you lose TRICARE.

ECHO is dedicated to serving qualified individuals who have special needs.

TAMP provides a bridge of health care benefits to help you get back on your feet after regular TRICARE expires.

It’s important to start researching and preparing early for your post-military health insurance. Consider talking with the experienced personnel who can help you with the shift at your post or base. They are invaluable resources to choose the best option possible for your situation.

Not Meeting the Veterans Coverage Requirements

Being enrolled in any of the veteran insurance benefits available for you and your family means you fulfil the requirements. But what happens when you are not fulfilling the requirements, and thus, not being able to enroll in any of the programs?

1. If you don’t have veterans coverage for yourself

Suppose you’re a veteran who isn’t covered by VA benefits or other types of veteran health care. There are several coverages available at the veteran Health Insurance Marketplace. This is determined by the size and income of your household. You might be able to get lower monthly rates and lower out-of-pocket costs with private insurance. You may also be qualified for Medicaid or the Children’s Health Insurance Program (CHIP), both of which offer free or low-cost health care.

2. If you don’t have coverage for your dependents

Another thing of concern is having dependents who require assistance but don’t fulfil the eligibilities of VA healthcare. Nothing to worry as they too can get coverage from the marketplace insurance options. Here, the coverage benefits also depend on the overall household size and income. If they are low, your spouse and child can get benefits like lower monthly rates and out-of-pocket insurance premiums.

Conclusion

Healthcare Coverage Options for Veterans is crucial. There are quite a few programs to look into that can help you and your dependent family members out. Veterans are an important part of our society. And so, there are several veteran benefits available for you that you can find out from our guide.

At BoomersHub, we value the services our military veterans have gone through for our beloved nation. If you need assistance finding any long-term care facilities such as assisted living, nursing home, independent living, memory care or home care, please feel free to get in touch. Our advisors will work alongside you to find the best possible option for you. Call us at +(877) 409-0666 or email: info@boomershub.com.

Frequently Asked Questions

Does military spending include veteran health care?

The Department of Defense and the VA provide health care to service members, retirees as well as eligible family members through the TRICARE Program. Eligible veterans and their families can receive health care at little or no cost.

Does veteran health care come from the military budget?

The Department of Veterans Affairs (VA) is a part of the Department of Defense, and as such, its budget is included in the military budget. However, they also received funds from Congress.