Article Contents

Introduction

By making wise insurance decisions, we can safeguard ourselves and our loved ones. Learn about the many insurance alternatives accessible in this article. From medical and dental care to life insurance and long-term disability, the health insurance covers everything. Get to know the essentials of insurance eligibility and coverage kinds. So, without further ado, let’s dive in the discussion.

Health Insurance for Seniors: Should You Get Insurance for Your Elderly Parents?

Dependent parents in their later years require health insurance coverage. They have a lot of health problems and require medical attention on a regular basis. Your parents are at great risk of developing health problems if they don’t already have them. Due to escalating medical expenditures, supporting your parents’ medical expenses may place a pressure on you.

That is why it is preferable to cover your parents’ medical expenses through a health insurance policy. Furthermore, when your parents are older, they may not be able to buy their own health insurance. As a result, you’ll need to get your parents’ health insurance. As a result, if they have a medical emergency, the policy will cover it.

In a traditional health insurance plan, the policyholder can only buy the plan up to a certain age. The majority of plans have an admission age limit of 60 or 65 years old. What about those in their fifties and sixties? Is it possible for them to obtain health insurance?

Yes, they are capable. In the market, there exist senior citizen health insurance plans. These plans exclusively help the parents who need health insurance. Let’s take a closer look at their plans.

What Is Senior Citizen Insurance?

Senior citizen insurance refers to a type of insurance specifically designed for older adults. It can help to cover the costs of medical care, hospitalization, including both routine expenses and unexpected emergencies. In addition, senior citizen insurance can provide coverage for other needs, such as prescription drugs, vision care, and hearing aids.

While the specifics of senior citizen insurance vary from one policy to another, it is an important tool for helping to protect the health and financial security of older adults.

For Seniors: Retiree Coverage

While retiree health insurance coverage can be a great benefit, there may come a time when you want to purchase your own health insurance plan instead. If that’s the case, you can do so, but there are a few things to keep in mind:

- Premium tax credits and other savings are only available to those who actually qualify as being enrolled in retiree coverage. You may be eligible for premium tax credits and lower out-of-pocket payments if you’re qualified for but not enrolled in retiree coverage. The size and income of your household determine the coverage.

- You will not be eligible for a Special Enrollment Period if you voluntarily drop your retiree coverage. You will have to wait until the next open enrollment term to enroll in health insurance.

Health Insurance Policies for Seniors

In recent times, healthcare has become one of the most expensive necessities. It can be challenging for seniors to identify the right health insurance policy. Usually, the plans are too costly or require extensive medical tests that can be difficult to undergo.1

Fortunately, based on the following criteria, you can find the plans that suit your needs the best!

- Entry age

- Premium

- Renewal age

- Pre-Existing diseases

- Waiting period

- Alternative treatments

- Sum Assured

- Sub-limit

- Co-Payment

Premiums are not the only factor to consider when choosing your insurance. Benefits like critical care, hospitalization expenses that can be covered under an appropriate policy should also come into play. If you need those extra feature, paying a higher monthly premium could be worth it down the line!

Due to the spiraling medical expenses, the higher your medical insurance, the better. Here are the best insurance policies for senior citizens.

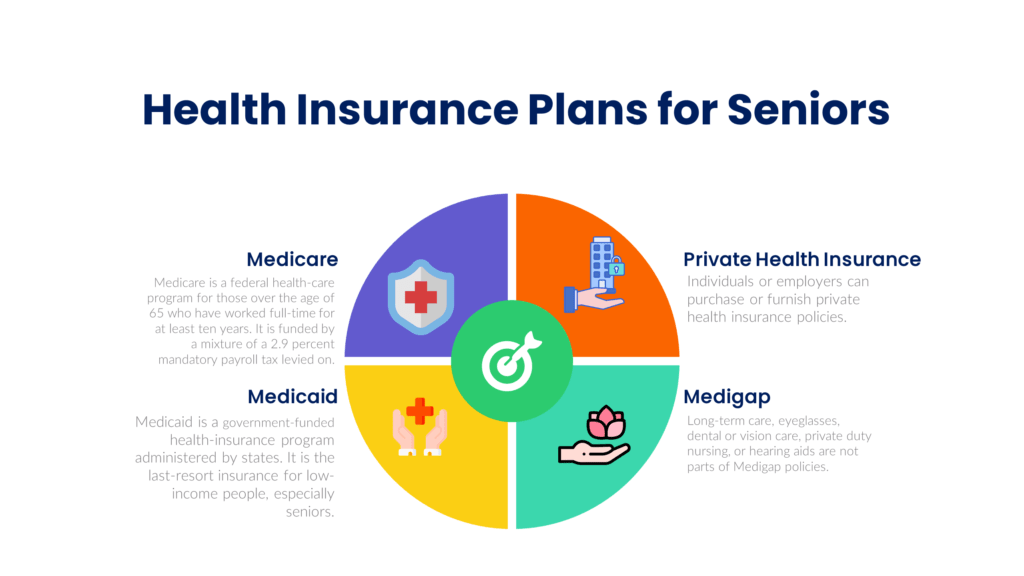

Medicare

Medicare is a federal health-care program for those over the age of 65 who have worked full-time for at least ten years. It is funded by a mixture of a 2.9 percent mandatory payroll tax levied on:

- employers and workers

- monthly premiums paid by enrollees

- and by the government.

Individuals with incomes over specific criteria pay an additional 0.9 percent tax:

- $250,000 when you are a couple and file jointly

- $200,000 if you are a single filer

Medicare has four parts:

- Part A, covers hospitalizations, skilled nursing care, and other healthcare and is mostly free.

- Part B, covers outpatient care like doctor visits, surgical procedures, medical supplies, etc. for $100 per month.

- Part C, is also known as Medicare Advantage and covers both hospitalizations and outpatient care. The cost varies depending on the provider.

- Part D, covers the expense of prescription drugs.

How much money a Medicare beneficiary will incur for their healthcare will reply on these factors:

- The type of care you need and how frequently you need them.

- The Medicare coverage option was selected.

- Whether or not a doctor will agree to charge the same rate Medicare is covering.

- If there are any other insurance plans that can fill in the gaps in coverage.

Medicaid

Medicaid is a government-funded health insurance program administered by states. It is the last-resort insurance for low-income people, especially seniors.

Medicaid eligibility requires that a senior have spent down most of their assets. Medicaid will cover the majority of the costs after achieving the financial floor. This encompasses a wide range of long-term health care options, such as nursing home and hospice care.

It’s important to know the rules of Medicaid in your state, because it can be a confusing process. Dual eligible seniors are those who may also get Medicare coverage- this means that there is even more protection for low income people with age restrictions on premiums and other benefits!

Private Health Insurance Plan

As a retiree, you may have the option to keep your private health insurance if it was provided by an employer. However most plans come with limited benefits and don’t cover everything that is needed for age-related illnesses or injuries. Besides, most of them have an expiery date. As a result, only a small minority of seniors are covered by private health insurance.

The cost to purchase private health care is expensive and can be a deciding factor for many people. Companies check an applicants’ general wellness, their age as well as any other health factors before offering coverage. Seniors with major medical issues or genetic predispositions may be ineligible for coverage.

Medicare Supplemental Insurance, usually known as Medigap, is a part of private insurers. You can expect Medigap coverage from expenses outside Medicare. They can also help to cover Medicare deductibles and co-pays. They also sell long-term care insurance to cover services that aren’t part of health insurance. Home health care, assisted living, hospice care, and nursing facilities are all examples of this.

Supplemental Health Insurance for Seniors Called ‘Medigap’

Supplemental health insurance for seniors is commonly referred to as Medigap. These policies are designed to help cover gaps in Medicare coverage, such as deductibles, coinsurance, and copayments. There are a variety of Medigap plans available, and each one offers different levels of coverage.

Some plans may also cover additional benefits, such as emergency medical care or prescription drugs. Seniors can choose the plan that best meets their needs and budget. Medigap policies are offered by private insurance companies and are regulated by the federal government.

Seniors who are interested in purchasing a Medigap policy should contact their local insurance agent or company for more information.

Long-term care, eyeglasses, dental or vision care, private duty nursing, or hearing aids are not parts of Medigap policies.

Other things to keep in mind concerning Medigap

- Only persons with Medicare Part A (hospital services) and Part B (outpatient services) are eligible for Medigap plans (doctor services costs).

- To make sure that you are covered for any conditions throughout your lifetime, it is important to enroll in Medigap coverage after turning 65. In the six months following your birthday month. Failure to do so may result in your insurer denying to pay or charge extra premium.

- The renewal of standard Medigap coverage is guaranteed.

- Only one individual is covered by Medigap coverage. You must get separate policies if you and your spouse both desire Medigap coverage.

- In addition to the Medicare Part B coverage you purchased, the Medigap coverage is paid directly to an insurance company.

What are the best health insurance plans for seniors over 65?

When it comes to selecting the best health insurance for seniors over 60, 65, and 70, there are several options to consider. The ideal choice depends on individual needs, budget, and personal circumstances. Here are some popular health insurance options for seniors in that age group:

- Medicare

- Medigap or Medicare supplement insurance

- Medicare Advantage plans

- Medicaid

- Private health insurance plans

Conclusion

The Partnership for Long-Term Care is a program available in 43 states. It combines private long-term care insurance and Medicaid long-term care coverage. The partnership helps potential users of Medicaid keep more of their assets. This is while still being eligible for the coverage.

Seniors can receive combined Medicare and Medicaid benefits under the Program of All-Inclusive Care for the Elderly (PACE). This includes those who wish to continue receiving medical, social and long-term care in their own homes rather than in a nursing home. It is available in 28 states.

The best health insurance plans for seniors are those that offer comprehensive coverage at a reasonable price. Many insurers offer policies specifically designed for seniors, and these policies typically include coverage for prescription drugs, hospital visits, and other medical expenses. It is important to compare the different plans available to find the one that best meets your needs.

Frequently Asked Questions

How much is supplemental health insurance for seniors?

Supplemental health insurance for seniors can vary in price depending on their location, the company, plan type, and benefit level. However, the average premium price ranges between $150 to $200 per month.

Can seniors get employer-supplied health insurance?

Yes, seniors can get employer-supplied health insurance. However, it is important to note that not all employers offer this benefit. According to the Kaiser Family Foundation reports, employer-sponsored health insurance for retirees or older adults has been decreasing significantly.

Can I add a senior dependent to my health insurance?

If a senior dependent is not eligible for Medicare or Medicaid, then it might be possible to add them to your healthcare plan. However, there may be certain rules and restrictions. You should speak with your insurance company to learn more about the coverage that is available for dependents.