Introduction

It’s that time of year when Medicare advertising starts to appear on your television, mobile, and computer screens. Many of these advertisements, though, might be confusing or deceptive. Have you constantly come across the Medicare flex card ads recently? If the answer is yes, it is time to look into the matter more in-depth before making a decision.

In this post, we’ll clarify the confusion about the Medicare flex card for seniors. A very common question about it is whether the Medicare flex card covers $2,880 amount for seniors or not. Let’s have a look into the overall concept in details.

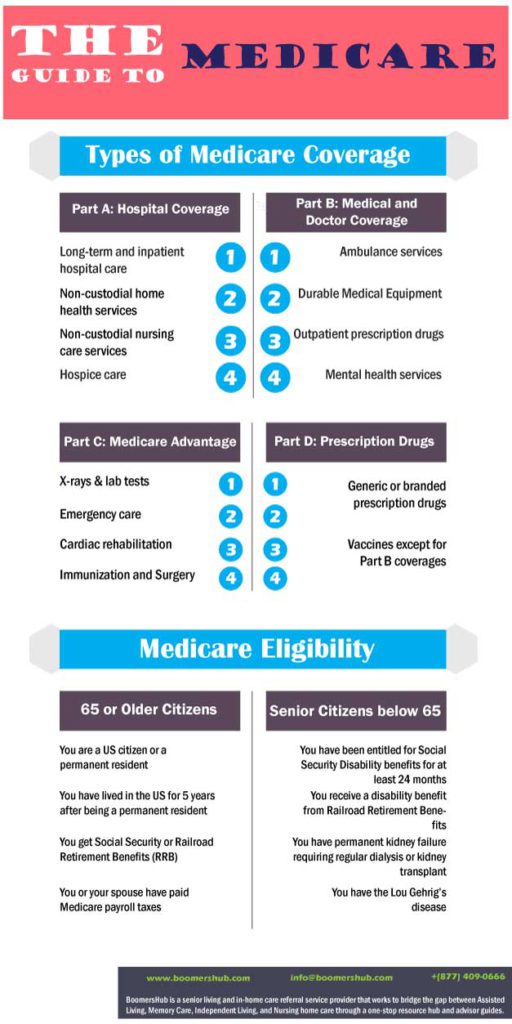

What Is a Medicare Flex Card?

A Flex Card is a card where you can store monetary values. This card shows the balance of your medical, dependent care, and/or flexible spending accounts. The card should be swiped through the scanner at the provider location using the credit card/debit card option as they don’t have any transaction fees or pin codes. When you swipe your Flex Card, money is taken out of your account instantly and directly.

Medicare flex spending cards are prepaid debit cards that are offered by a few private insurance providers and come with a few plans. The spending limit on the card and what you can use it for varies with every plan. Eligible Medicare beneficiaries can use this to pay for their medical expenses.

What is Flexible Spending Account (FSA)?

The Federal Flexible Spending Account Program (FSAFEDS) enables Federal employees to save money on eligible health care (HCFSA) and dependent care (DCFSA) expenses through tax-advantaged flexible spending accounts. Participants save an average of 30% on their family’s health, dentistry, vision, and daycare expenses by using pre-tax payroll contributions rather than post-tax wages to pay for these out-of-pocket charges.

You can choose the amount to invest in an FSA till the employer-determined limit. Flexible Spending Arrangements are another name for FSAs. This money isn’t taxed. If there is money left over at the end of the year, the employer has two choices but not both:

- You get 2.5 more months to spend the left-over money.

- You can carry over up to $500 to spend the next plan year.

How Does the Medicare Flex Card Work?

The flex card advertising makes statements that cause beneficiaries to assume that money from Medicare, up to $2,880, would be transferred to a flex card. This, however, is not the case. While some carriers provide this advantage, it is uncommon to get such a huge sum. In 2022, the average Flex Card will have a $500 pre-loaded balance.

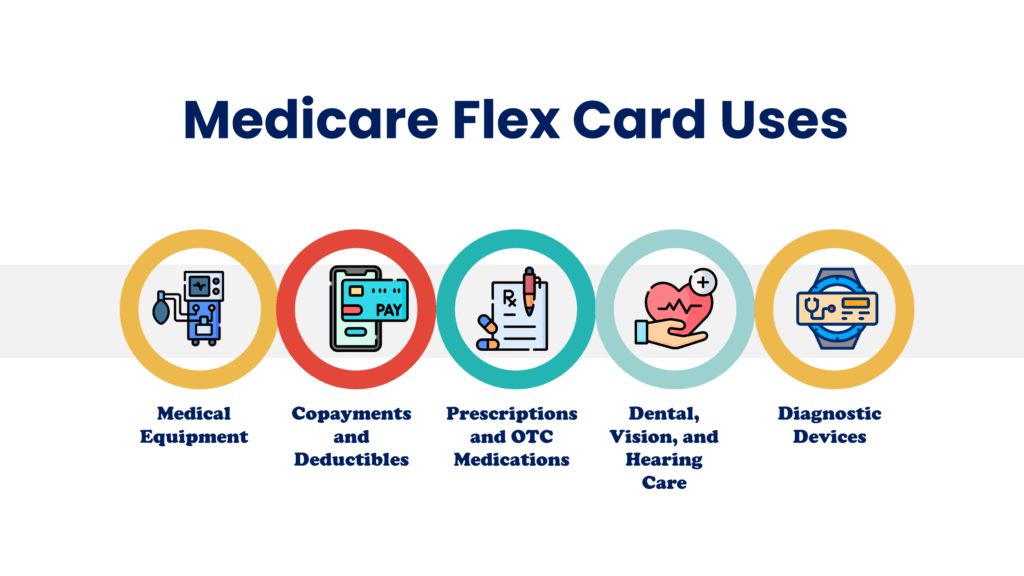

Medicare flex spending cards can be used for medical bills that meet certain criteria. They may be advantageous to seniors who have a Medicare plan. For example, the flex card can be used for the following expenses:

How to get a flex card for seniors?

During the annual Federal Benefits Open Season in November and December, eligible employees can enroll in FSAFEDS. New or newly eligible employees have 60 days from their start date to enroll in benefits outside of Open Season. Still, they must do so on or by September 30. Employees who are eligible can enroll outside of Open Season within 60 days of a Qualifying Life Event (QLE), such as marriage or birth. Still, they must do so by September 30. During Open Season, newly eligible QLE employees who missed the September 30 deadline can enroll.

You can visit the FSAFEDS website or call 1-877-FSAFEDS (372-3337) or 1-800-952-0450 to enroll in the program.

Who is eligible for the FSAFEDS account?

You must be employed by an agency that participates in FSAFEDS in order to be eligible for a health care flexible spending account. Additionally, you must be eligible to enroll in the Federal Employees Health Benefits Program (FEHB), though you do not really need to be enrolled in FEHB.

From January 1 through December 31, you will be eligible for benefits. Expenses incurred during that time frame can be reported until April 30th of the following year. The FSAFEDS will automatically carry over up to $500 of unspent funds into your health care or limited expense account for the following calendar year if you have not exhausted it by December 31st.

To be eligible for carryover, you must be employed by an FSAFEDS-participating agency and actively making allotments from your salary from January 1 to December 31 of the previous benefit period. In addition, you must actively re-enroll in a health-care or limited-expenditure account during Open Season to use carryover.

Medicare flex card eligibility for seniors

So, you must be wondering who qualifies for Medicare flex card, or what are the Medicare flex card eligibility requirements for seniors. Flex cards are frequently offered in conjunction with health insurance coverage. To qualify for a flex card, you must have health insurance that offers a flexible spending account.

The senior flex card is usually linked to a Medicare Advantage plan. These optional plans combine Medicare and additional services into healthcare packages tailored specifically for seniors. But it is important to keep in mind, that very few advantage plans participate in the flex card program across the country.

How to Know If Your Flex Card Is Legit?

You’re not the only one who feels this way! Countless people have contacted us, questioning if this is a genuine offer or a blatant hoax. For a total of $1,600 per year, the most extensive valid flex plan identified featured a $1,000 flex card and a $50 monthly debit card for other out-of-pocket expenses. That’s a lot less than the original asking price of $2,880.

Even if you are eligible, you should carefully consider any Medicare Advantage plan. Although the flex card is an appealing offer, you must ensure that you are not foregoing other significant health-care advantages in order to obtain it. In addition, you may end up paying the price in other aspects of your plan if you don’t read the tiny print thoroughly.

Finally, the amount of money you might be able to get on a flex card depends on where you reside and whatever plan you choose. Flex cards aren’t available in every state, and not every carrier offers them. It’s better to contact your insurer directly to determine if your plan includes this benefit. On Medicare.gov, you can also look up the advantages of your plan.

Why Seniors Should Be Careful About Medicare Scams?

Medicare open enrollment season is a prime time for scammers who want to prey on seniors. Because this is when seniors can alter their health care plans, the open enrollment period is between October and December. They often try to steal people’s personal information or sell them bogus health insurance plans by collecting their personal and financial information. People need to be aware of these dangers and be careful when interacting with strangers during this time.

Apart from that, some affiliated websites receive payments from medicare advantage providers for persuading customers to buy their products. So even though they aren’t technically fraudsters, some of them don’t mind being deceitful in their marketing.

3 Ways to Protect Yourself from Medicare Scams

The purpose of the flex card for seniors is to entice them into enrolling in new Medicare Advantage plans during open enrollment season. But more often than not, you might find yourself attracted towards a scam that can take all your money. So, here are 3 ways you can protect yourself from most Medicare frauds.

1. Don’t provide your personal information online

You should never submit sensitive information online to unfamiliar companies as a general rule. Unfortunately, there are some unscrupulous people out in the world who claim to work for Medicare. Don’t give them any of your personal information! They will only use it against you and take advantage when they have access or knowledge that can financially harm someone, so beware! It’s a significant red flag if someone contacts you and then requests your personal information. We always have the tendency to give into fear and provide them the personal information. But it’s best to stay calm and not fall into the trap.

2. Avoid taking unsafe advice

It’s not just online that you need to be cautious. You should also be aware of in-person advisors who have hidden motives. It is always best to be aware of your surroundings and avoid people who approach you without your permission.

3. Find a trustworthy Medicare counselor

Reaching out to your local Area Agency on Aging is the best approach to finding a trustworthy Medicare consultant. The Health Insurance Counseling and Advocacy Program is a service offered by many states to help people navigate the complicated benefits.

Conclusion

If you are looking for a way to pay for your medical expenses, a Medicare flex card may be the right option for you. We hope this blog will help you get started on the process and answer any questions you may have about these cards. To find more content like this, visit BoomersHub website today!

FAQs

What is the 2800 Flex card for seniors?

The $2,880 flex cards for seniors are actually a health insurance marketing strategy aimed to entice seniors to switch to specific Medicare Advantage plans.

Is there really a flex card for seniors?

Medicare does not provide flex cards to seniors, to be honest. As a result, it is not a senior program that the government runs. The cards in the advertising are distributed by private Medicare Advantage programs, not by Original Medicare. As a result, several reputable insurance providers provide this service.

Is the Medicare Flex Card legitimate?

Yes, Medicare flex card is legitimate. However, it might not be exactly what you see in the ads.

What is the Flex card for seniors?

Flex cards are debit cards that have usage in purchasing medical supplies and equipment. These cards, which are usually tied to a flexible spending account, are a benefit that qualified health plans offer across the country.

How can I get another Medicare card?

If you unfortunately lose or destroy your Medicare flex card, you can seek a replacement through your personal Social Security account.

Does Medicare offer free flex cards for seniors?

While some private insurer-run Medicare Advantage plans include flex cards worth a few hundred dollars, they are not available for free through original Medicare.

Is the Medicare flex card free for seniors?

A flexible spending account, or flex card, is a type of flexible spending account that reimburses medical expenses. This card, however, must be linked to a Medicare Advantage Plan, which is a paid service. So, it’s not free; you’re unlikely to recoup $2,800.00 or anything close to it.