Introduction

When the health and dependency of seniors become an issue, it becomes a tough decision to send them to senior living facilities. Although relocating a senior is never an easy option, assisted living may be of greater assistance than you realize. Knowing that your loved one is being cared for in an environment that fosters healthy living and sociability can relieve a lot of your stress. And bridge loan in senior living is just the right thing for that.

Oftentimes, families are concerned about the cost of an assisted living home. And seniors might fail to consider health care costs into their retirement income plan. Thus, it becomes challenging to manage senior living costs.

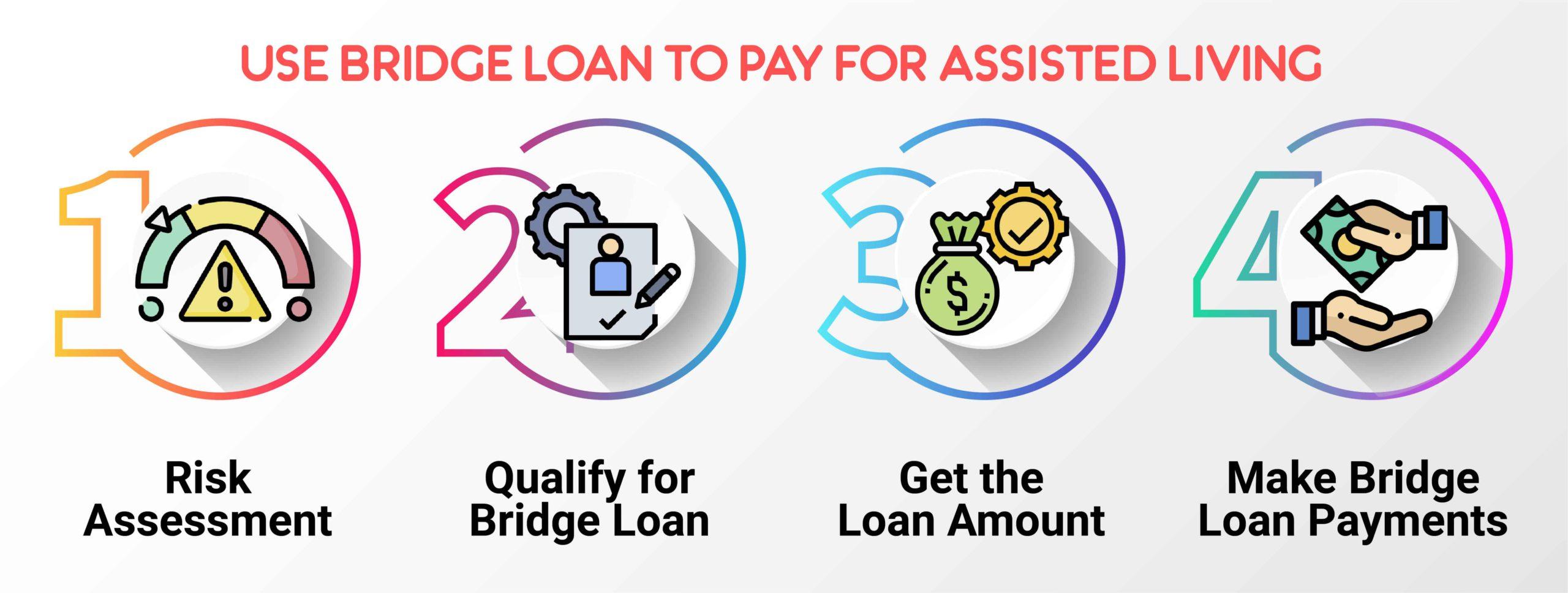

In such a situation, you can take loans to cover the expenses. Thankfully, seniors have a variety of funding alternatives. For example, bridge loans are one of the most prevalent ways to pay for assisted care. This form of financing can aid you in subsidizing the costs of an assisted living facility. Also, it ensures that loved ones receive the complete care they need.

This article will explain how a bridge loan works in senior living, how much the payment is and what risks you should be aware of.

A Brief Idea on Bridge Loans

A bridge loan is a type of short-term borrowing used to “bridge the gap” or pay unpaid bills. For example, this type of loan is frequently used when someone is shifting to a new home.

A bridge loan can provide funds to help you buy a home or contribute to a down payment. You can get a new property even before you sell your current house.

A bridge loan can provide funds to help you buy a home or contribute to a down payment. You can get a new property even before you sell your current house. Instead of buying a house, seniors can cover the costs of assisted living.

Using Bridge Loans for Senior Living Payments

A majority of the seniors use property selling money to bear the expenses of senior living communities. But a considerable portion of them cannot wait for their home to sell before relocating to an assisted living facility. This is because they require immediate home care. Also, if the property market is stagnant, a senior may find it difficult to wait long before transferring. This makes a bridge loan an appealing option.

Thus, obtaining a bridge loan allows seniors to cover the costs. As a result, it can alleviate the stress until other further funds are needed.

But the question is- why is a bridge loan so preferable for seniors? Seniors who utilize a bridge loan to pay for an assisted living facility would have regular costs rather than one huge fee. That is why it is preferable for elders to take out a loan.

Bridge Loans Have Some Risks

Before applying for a bridge loan, seniors should be informed of the dangers and regulations. This is considerable for any kind of financing.

For instance, bridge loans are usually considered with the idea of repaying the loan amount with the sale of the current property. But what if you don’t sell your house before the due loan? This can make you pay 3 different kinds of payments altogether. Those are:

- Mortgage payments

- Assisted living expenses

- Bridge loan payments

Thus, consider doing some research on the current housing market before taking out a bridge loan. This way, you’ll have a rough idea of how long homes can take to sell.

Some more negative aspects of bridge loans

You may also want to consider alternative choices before investing in a bridge loan. For example, there could be several other options like:

- Home Equity Line of Credit (HELOC)

- Borrowing against the 401(k) plan

- Getting a loan secured by bonds, stocks or other assets

Other disadvantages of a bridge loan include:

- A high cost of origination

- Much costlier than home equity loans

- High-interest rates

- You must have the qualification to own 2 homes

How to Repay the Bridge Loan Amount

After taking out a bridge loan, you’ll have to start paying it back quickly. Several creditors are willing to loan above $185,000 for a period of 12 months. If you require a loan increase or a longer repayment period, your lender will assess your situation. But this may take you through further hassles.

The good news is that bridge loan repayment choices can be structured in a variety of ways. But, lenders often include a “balloon payment” in the last three months when the entire amount is due on a specific date.

Bridge Loan Eligibility for Seniors: 2 Key Documents

Before you consider taking a bridge loan, you will have to be eligible for it. You will need 2 documents to apply for a bridge loan. They are:

- A copy of your current home’s sale agreement

- Your new home’s purchase agreement

But you might not have a specific selling date for your property. In such a case, your choice is to seek private lenders. This is because every bank makes it mandatory to submit these 2 documents.

Conclusion

When families are considering assisted living communities for their elderly parents, it’s critical to have a strategy in place. Especially for the payment of the expenses, a bridge loan may be the best option.

Bridge loan in senior living is just like any other loans you take from banks or private entities. The best part is that you can use it to bear the senior living facility expenses without any hassle.

For a senior, it can still be confusing and troublesome. But, don’t worry, we have got you covered. Reach out to us to get advisor helps on a bridge loan for senior living.

Frequently Asked Questions

How long does it take to get a bridge loan?

It typically takes two to three weeks to get a bridge loan. However, it can also be approved within three to five working days.

What is the interest rate on a bridge loan?

The interest rate on a bridge loan varies, but usually, it ranges between 8.5% to 10.5%. It is higher than the interest rate on a traditional loan, but the processing time is much less.

Are bridge loans hard to get?

Bridge loans are not hard to get, but they can be difficult to qualify for. In order to be approved for a bridge loan, you will need to have a good credit score, a low debt-to-income ratio, and be able to provide proof of income.

Are bridging loans safe?

The safety of a bridging loan depends on a number of factors, including the lender you choose, the terms of the loan and your financial situation. That said, bridging loans can be a risky proposition, so it’s important to do your homework before taking out one.