Memory care is a crucial service many elderly individuals and their families require. It’s a type of long-term care designed to support seniors with memory impairments such as dementia, Alzheimer’s, and Parkinson’s disease. However, it can be a costly investment that many cannot afford. In addition, many families are unaware of the various financing options available or how to choose the right one that fits their needs.

In this post, we’ll cover everything you need to know about paying for memory care, from understanding the costs associated with it to explore the different financial resources available. So you can make an informed decision and ensure your loved ones receive the care they need.

What factors impact the cost of memory care?

While every family’s financial situation is different, it’s essential to understand the cost of memory care to cut unnecessary costs. So now, let’s look at the factors that influence the cost of memory care.

1. Location

One of the main factors that impact the cost of memory care is the facility’s location. The cost of care can vary widely depending on where you live. For example, if you live in a major city, you can expect to pay more for memory care than in a rural area. That is because the cost of living is generally higher in cities, which means the cost of care is also higher.

2. Level of Care

Another factor that impacts the cost of memory care is the level of care your loved one requires. The more advanced the care, the higher the cost. For example, older adults with early-stage dementia may only need help with activities of daily living, while more severe patients may require 24/7 medical attention, therapy sessions, etc.

3. Amenities and Services

The amenities and services that a memory care facility offers can also impact the cost of care. Some facilities offer various amenities like daily activities, transportation, and on-site medical care. Other facilities may offer fewer amenities but provide more personalized care.

What is memory care financial assistance?

Memory care provides specialized care tailored to the unique needs of individuals with memory issues. But due to its high costs, many families struggle to afford it. That’s where memory care financial assistance comes in. These types of financial aid are available to help families pay for memory care services.

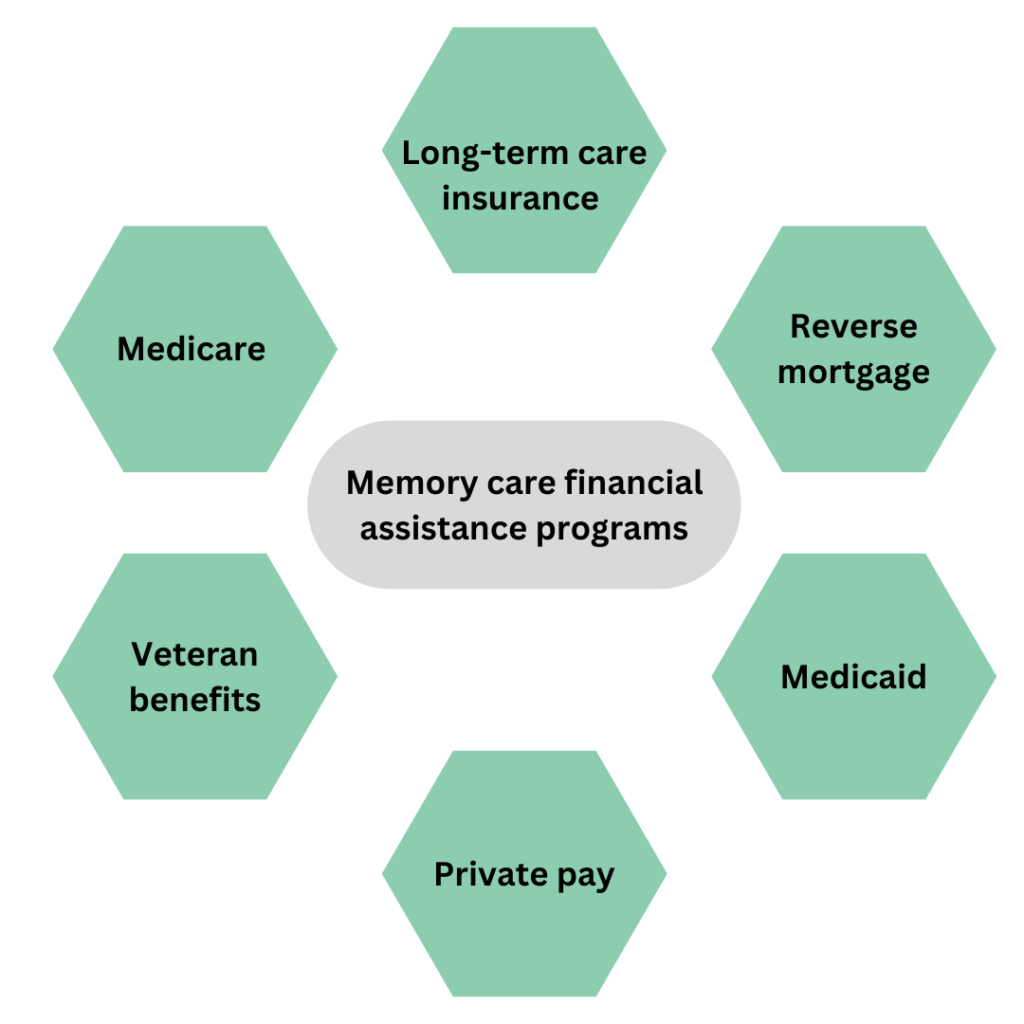

There are several types of memory care financial assistance available, each with its own eligibility requirements and application process. From government programs like Medicaid to private insurance to personal savings, there are various ways to pay for memory care.

How to pay for memory care?

Most people pay for memory care using a combination of personal funds, insurance, and government programs. If you are thinking about how to pay for memory care, here are some options to consider:

1. Long-term care insurance

Long-term health insurance is a type of insurance that covers the cost of long-term care, including memory care. But keep in mind that long-term care insurance plans can be expensive with hefty premiums, and not all policies cover memory care. Additionally, some policies have waiting periods before benefits kick in, so be sure to read the fine print.

2. Reverse mortgage

Reverse mortgages can be another way to pay for memory care. It allows you to borrow against the home. These amounts can be received monthly, in lump sum, or through a credit line. However, reverse mortgages can be a complex process, so it’s good to speak with a financial advisor or elder law attorney to understand the potential impact on your overall financial situation.

3. Medicare

Medicare is a government program that may be used toward memory care costs of older adults aged 65 or above. However, Medicare only covers nursing home care for a limited time, typically up to 100 days. After that, you’re on your own. So, if you need long-term care, like memory care, you’re going to have to pay out of pocket. That is unless it’s deemed medically necessary for a short-term period.

4. Medicaid

Medicaid is a federal and state-funded program that health insurance to seniors and low-income individuals. To qualify for Medicaid, you must meet specific income and asset requirements, which vary by state. If you meet the requirements, Medicaid may cover the cost of room and board in a memory care facility, as well as medical care and other services. However, keep in mind that not all memory care facilities accept Medicaid, so you’ll need to do your research to find one that does.

5. Veteran benefits

Veterans and their families who need memory care can receive financial assistance to cover the expenses based on eligibility requirements. These requirements are determined by factors such as the veteran’s service history, income, and health status. The Department of Veterans Affairs provides a range of services to assist veterans and their families in navigating the application process and comprehending their options.

6. Private pay

When it comes to paying for memory care, private pay is the optimal choice. However, for most seniors with a fixed income, it may not be the most convenient option. Therefore, it is recommended to consider a combination of other financing options mentioned earlier.

How to pay for memory care

Final thoughts

Paying for memory care can be a daunting and overwhelming task. However, it is not an impossible one. One of the most important takeaways from this post is that planning ahead is key. Whether it be through long-term care insurance, Medicaid, or personal savings, taking the time to plan for potential memory care expenses can make a significant difference in the long run.

We hope this blog has provided you with valuable information and insights about how to pay for memory care. Remember that you are not alone in this journey, and there are resources available to help you make the best decisions for your loved one and your family. If you need more information on this topic, please give us a call today!

Related articles:

- How to pay for nursing home?

- How to pay for assisted living?

- Paying for home care: what are the options?

- What are the alternatives to memory care?

- How to Choose Memory Care Facility (Checklist)

FAQs

- Is care for dementia patients free?

Unfortunately, care for dementia patients is not always free. Families may need to pay for care out of pocket or purchase private insurance that covers dementia care. But there are some government programs such as Medicare, Medicaid and Veterans Benefits that can cover portions of the cost.

- What is the average cost of memory care in Texas?

According to memorycare.com, the average cost of memory care in Texas is $4,998 per month.

- What can you do when you can’t afford memory care?

Memory care can be expensive, and not everyone can afford it. But here are a few things you can do when your money runs out:

- Look into government-funded programs that provide financial assistance for senior’s care

- Explore community resources and local non-profit organizations

- Consider hiring a caregiver to provide in-home care, as it can be more affordable than a memory care facility.

- Consider alternative housing options such as assisted living or independent living

- Use personal savings or sell assets

- Seek help from friends and family or crowdfund your cost of care