Article Contents

Introduction

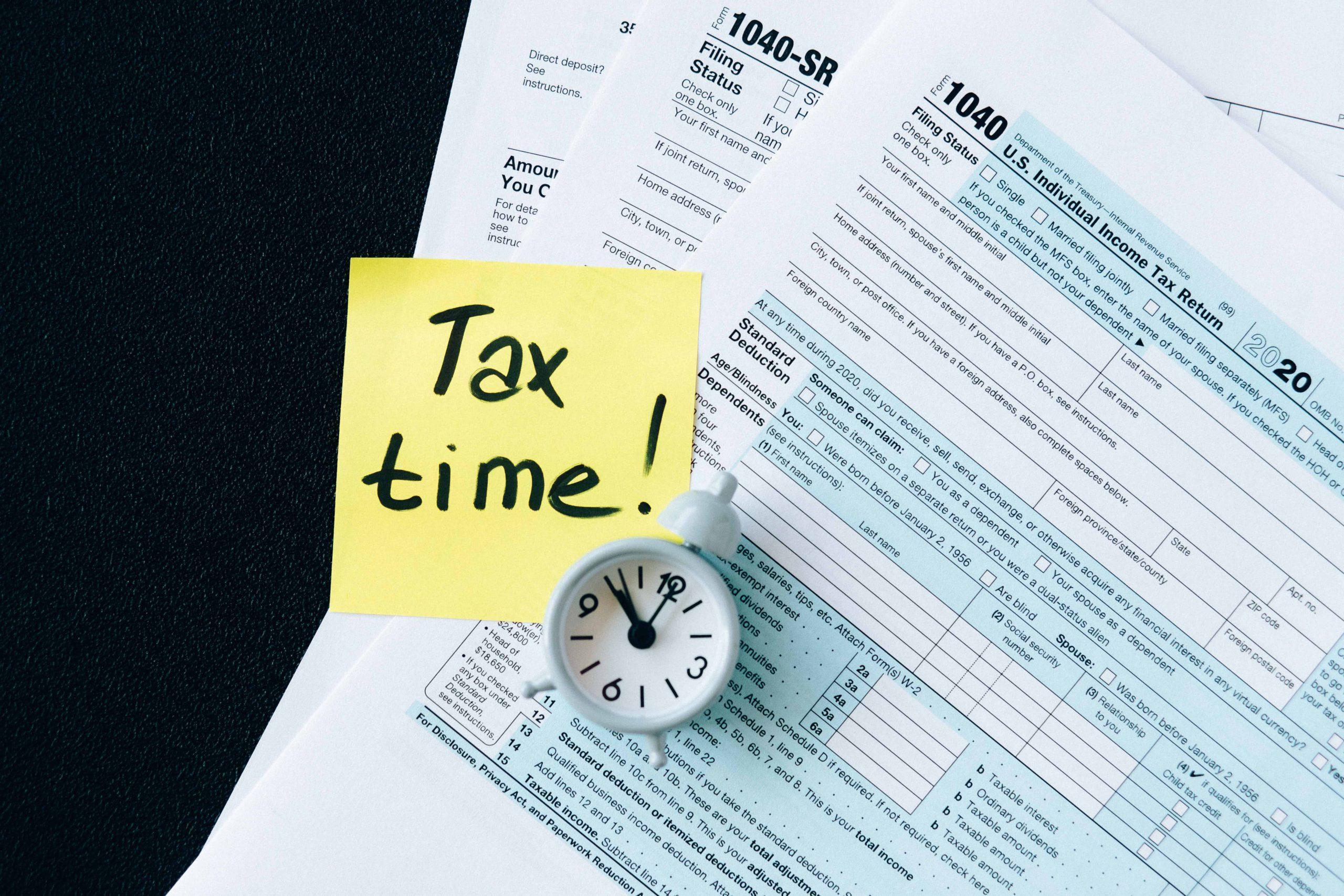

With tax season in full gear, seniors should stay organized and ensure their taxes are handled thoroughly and precisely. Filing taxes as an adult can be difficult and time-consuming. Social Security payouts, retirement savings, and pensions are all subject to a slew of regulations. The IRS and AARP have free local services to help make tax time a little less stressful in towns across the country.

In this article, we will briefly look into preparing for the tax season through different assistance programs. But that’s not all, we have some crucial income tax preparation tips for you as well.

Income Tax Preparation Tips for Seniors

The majority of people despise tax season. Filing is a time-consuming and perplexing procedure; tax regulations are constantly changing, and it’s stressful not knowing if you’ll owe the government more money or receive a tax return check.

Fortunately, more and more tax preparation services for seniors are becoming offered to Americans. So whether you’re having trouble preparing your own taxes or need elderly tax assistance filing on behalf of an aging loved one, the list of resources below is likely to have the answers you need.

AARP tax help for seniors

The AARP Foundation offers the nation’s most extensive volunteer-run tax preparation and assistance service to everyone, with a focus on low- and moderate-income taxpayers and those 50 and older. The Internal Revenue Service assists all AARP tax counseling for the elderly with trained and certified volunteers (IRS). Seniors can also prepare their own taxes online with the guidance of a tax consultant or completely on their own using free tax-filing software through Tax-Aide.

IRS AARP tax aide programs

Taxpayers can prepare and file their federal income tax for free using the IRS Free File Program in two ways:

On IRS partner sites, traditional IRS Free File offers free online tax preparation and filing choices. IRS partners are online tax preparation companies that create and supply this service to eligible clients for free. Please note that any IRS Free File partner offers are only available to taxpayers with an Adjusted Gross Income (AGI) of $72,000 or less.

Electronic federal tax forms that you can fill out and file for free online are known as Free File Fillable Forms. You should be able to prepare your own tax return if you choose this option. It should be noted that for taxpayers with an AGI of more than $72,000, this is the only IRS Free File option available.

The IRS has your back if you just need to know what forms of retirement income are taxed or what the eligibility conditions are for certain tax deductions and credits. For tax questions pertaining to seniors and retirees, go to the IRS Tax Information for Seniors and Retirees website.

Area Agencies on Aging

Seniors are served through Area Agencies on Aging (AAAs) in cities around the United States. AAAs provide a variety of services, benefits, and resources to assist elders and family caregivers. You may need to explore alternative sources of assistance if IRS and AARP tax help appointments are restricted or unavailable in your area. Contact your local AAA to see if there are any other free or low-cost tax preparation resources in your area.

Tax Counseling for the Elderly (TCE)

IRS-certified volunteers provide tax preparation assistance to persons 60 and older through a federal grant program. (The AARP Foundation Tax-Aide runs the majority of TCE sites.) For further information, call 888-227-7669 toll-free or check online resources and websites.

Volunteer Income Tax Assistance (VITA)

Another free tax filing for seniors is the IRS Volunteer Income Tax Assistance (VITA) program for taxpayers who make less than $58,000 per year, have a disability, or have low English skills. In addition, all taxpayers, particularly those aged 60 and over, can take advantage of the IRS’s free Tax Counseling for the Elderly (TCE) program. Volunteers with VITA and TCE are IRS-certified, and these locations are open from February to April.

Top 7 Tax Preparation Tips for Seniors

Taxes aren’t everyone’s favorite topic, but being informed and aware of the regulations, which can differ for seniors and retirees, can help you save time and money when it comes to submitting your annual tax return. While not a replacement for expert tax counsel, these senior tax guidelines will help you understand what your tax obligations may be as you plan for 2022.

1. Review your credits and benefits

People 65 years of age and older are eligible for many tax benefits – some of which might even seem surprising. One such benefit relates to itemization. There is a standard senior deduction, and this could be higher than the deduction you would get if you itemized your deductions instead. Another benefit to knowing is the Care for the Elderly or Disabled credit. This benefit only applies to people who are disabled or have a spouse that is disabled, and the amount you can expect to receive is based on your age, your filing status, and your income.

2. Be wary when dealing with Social Security

Determining the taxable amount of your Social Security benefits can be a painful process. If you typically prepare your own taxes, you must complete the Social Security benefits worksheet as carefully as possible. It might even be a good idea to ask for two forms so you can double-check your work. Keep in mind – if your provisional income exceeds $32,000 a year, then you have to pay taxes on your Social Security.

3. If at all possible, have someone prepare your taxes for you

Being careful is the best way to avoid paying too much and understanding when you are entitled to more. If this all already seems like too much, it might be wise to have someone prepare your taxes on your behalf. Even better – you can likely get this service for free. The Tax Counseling for the Elderly (TCE) is a service available to taxpayers 60 years or older. Volunteers certified by the IRS will go over your taxes with you and help you through everything – including your final filing. The IRS-certified volunteers are also knowledgeable about pensions and other items relevant to seniors. The IRS website has a useful locator to help you find a TCE representative close to you. Experts are available – why not take advantage?

4. Max out retirement plan contributions

You should increase your employer-sponsored contributions to 401(k), 403(b), or another tax-deferred retirement account if you’ve been thrifty in the past. Your taxable income for the year is reduced as a result of the money you put into these accounts, lowering your tax obligation. It is not taxed until you take it out.

Contribution limits for 401(k)s in 2021 are $19,500, plus $6,500 in catch-up contributions if you’re 50 or older. Contribution limits for 2021 are $6,000 plus $1,000 in catch-up contributions if you hold an IRA through a broker or bank.

5. Consider bunching deduction

The standard deductions have almost doubled in recent years, making itemizing difficult. For example, individuals may deduct $12,550, heads of households could deduct $18,800, and married couples filing jointly could deduct $25,100 in 2021. Taxpayers who don’t have enough deductions to surpass such thresholds take their standard deduction.

6. Convert traditional IRA to ROTH IRA

A Roth IRA offers two significant tax benefits over a standard IRA. Withdrawals are not considered income for federal (and most state) income tax reasons. Also, you are not required to receive RMDs from them beginning at the age of 72. Just keep in mind that converting an IRA to a Roth IRA is taxable income, which will increase your tax burden for the year. In general, in a low-income year, it’s advisable to convert to a Roth IRA.

7. Watch out for scammers

Scammers find every opportunity to prey on innocent people. And it is not unusual for them to try and take advantage of older adults during tax season. If you get a weird phone call, email, or text from the “IRS,” you need to ignore it. The agency will never use these methods of communication to request any personal information.

Scammers try and capitalize on every tragedy, natural disaster, holiday, and other negative occasions to take advantage of innocent people, including older adults. It’s important to know that the IRS and other government agencies will never try and contact you through phone, text, email, or any other method to request personal information from you. If you do get a scam call, definitely hang up (and keep hanging up if they keep calling). Don’t let them frighten you by saying you owe back taxes. Do not wire anybody money over the phone. You can learn more about Scams here.

Conclusion

Tax preparation can be a daunting task for seniors, but it doesn’t have to be. Make sure to review your credits and benefits, stay up to date about social security and other benefits, and seek help if things become too overwhelming. Finally, watch out for scammers! We hope you found this information helpful and that it makes filing your taxes a little less stressful.

For more resources about all aspects of senior living and lifestyle, including other financial tips, visit BoomersHub to access information and guidance vetted by experts.

FAQs

Where can senior citizens get their taxes done for free?

Qualified individuals can get free essential tax return preparation through the IRS’s VITA and TCE programs. The VITA program has existed for almost 50 years.

Do seniors have to file taxes?

Yes. Even if you are not employed, you must file taxes once a year. Even if you don’t have any money, filing taxes allows you to receive advantages, credits, or deductions.

Do seniors with social security have to file taxes?

The positive news is that 15% of your social security benefits will never be taxed. But what about the remaining 85%? If half of your social security income, plus other taxable income is less than the “basis amount,” no social security is taxed. So there are no social security taxes if you earn less than the primary amount for your filing status.

Do low-income seniors have to file taxes?

If you live on a low income and receive the Old Age Security Program’s guaranteed income supplement or allowance payments, you must file your taxes by April 30 to ensure that your benefits are renewed.

Where can seniors file taxes for free?

Simply go to IRS.gov/freefile on your computer or mobile device. Mobile devices are supported by all Free File offerings. In addition, other free solutions exist for seniors who may not feel comfortable preparing their own tax returns. For example, the IRS supports volunteer Income Tax Assistance, and AARP supports tax Counseling for the Elderly.

How much can a retired person earn without paying taxes?

If you file as an individual, only if your total income for the year is less than $25,000 is your Social Security not taxed. However, if your income is anywhere between $25,000 and $34,000, half of it is taxable. If your income is more than that, up to 85% of your benefits may be subject to taxation.

When can seniors stop filing taxes?

If you are a senior who is not married and earns less than $13,850, you can stop reporting income taxes at the age of 65. You are a married senior who intends to file jointly and earn less than $27,000 in total. You can also stop filing taxes if your only source of income is Social Security benefits. This is due to the fact that taxable income excludes benefits. As a result, without Social Security, your gross income is technically $0.